Your all-in-one finance and payroll partner, built for recruiters

Payflow’s invoice funding gives you the freedom to grow your recruitment business without the stress of back-office admin or cash flow gaps. For one simple fee, we handle everything – from processing timesheets and raising invoices to paying candidates and managing credit control, so you can focus on what you do best!

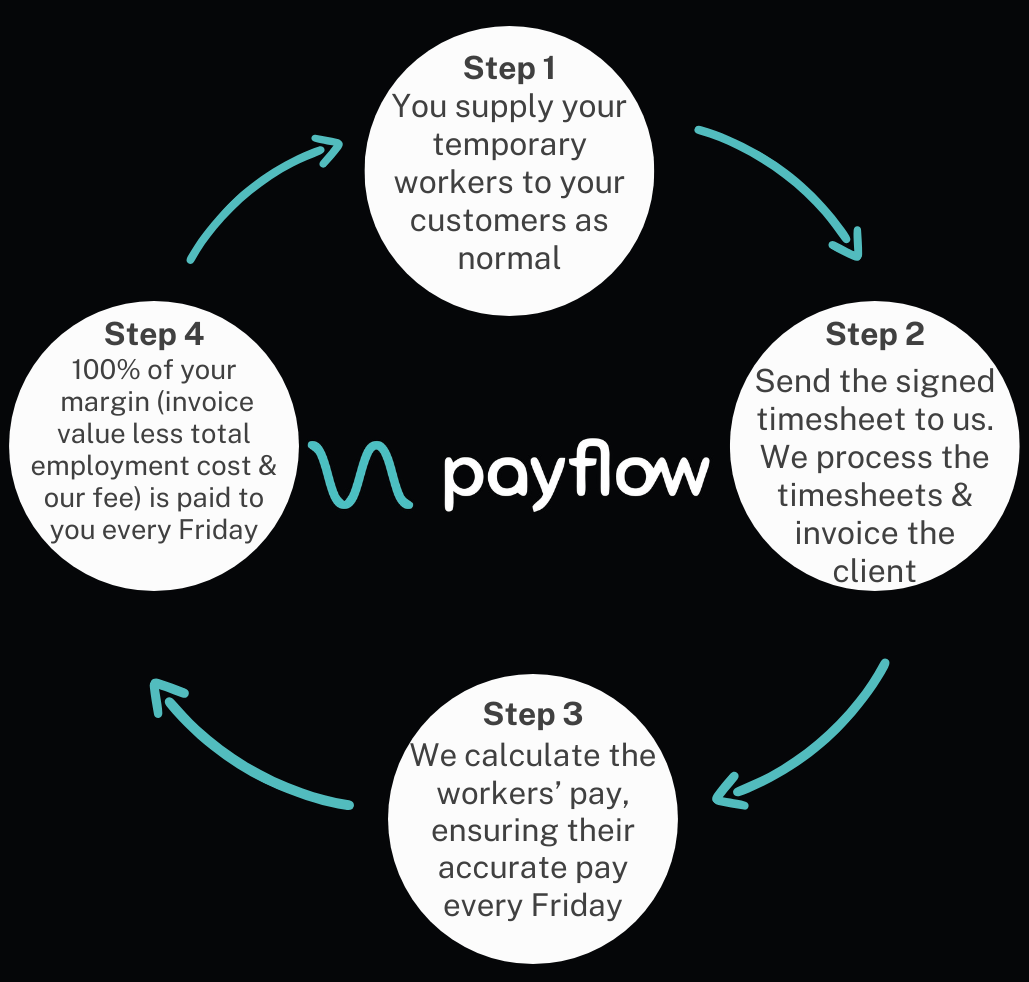

Payflow Cycle

You’ll receive 100% of your weekly profit, even before your clients pay, with all invoices protected by our Bad Debt Protection. It’s a cost-effective, integrated solution that replaces the need for a full back-office team. Whether you’re launching a new agency or switching providers, Payflow makes funding fast, simple, and secure.

Unsecured flexible financing of your payroll

Bad Debt Protection

With Payflow’s Bad Debt Protection, you’ll never be left out of pocket if a client fails to settle their invoice.

One Simple Fee

Keeping it simple, there are no hidden costs or surprises with Payflow– one fee covers all!

No Maximum Funding

Your growth is never capped, and your cash flow scales with your business – no funding limits, ever.

Benefits of Payflow’s Financing

Fit For any Business

No matter your size or sector, Payflow’s tailored payroll service is on time, every time. We support businesses across industries with accessible, dependable funding.

No Security, No Problem

Our facility is unsecured meaning no debenture, no personal guarantee, and no disruption to your existing bank arrangements. It’s a seamless way to enhance your cash flow without tying up assets or interfering with your current finance setup.

Fuel Your Business Growth

Boost your cash flow and unlock working capital to keep your business moving forward. Whether you’re scaling up, covering gaps between invoice payments, or managing day-to-day expenses, our solutions give you the flexibility to grow on your terms.